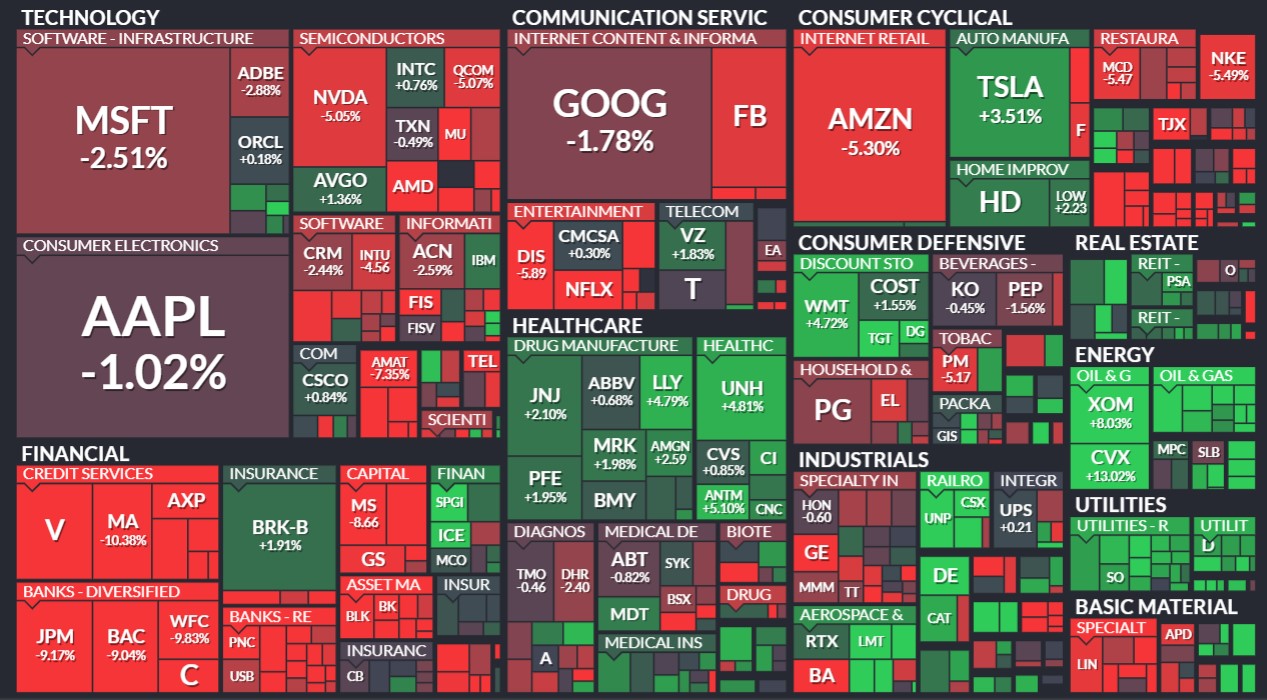

Heat maps and more

Category: Weekly Market Report

Market Summary for the Week of January 16th This week was a wild ride with the market going bullish. But will it stay that way? SPY Friday we closed a few cents above the 200 EMA on the daily. Let’s hope this holds. Keep an eye on the longer term weekly as well. Still much … Read More “Market Summary for the Week of January 16th” »

The Death of the 60/40 Portfolio Is Greatly Exaggerated I’ve seen so many articles, and listened to so many podcasts this week about the death of the 60/40 portfolio (60% Equities / 40% Bonds). Now I’m not saying it’s right for everyone, however just taking a look at the past 12 months is not how … Read More “Quick Hits for the Week of 10/23/22” »