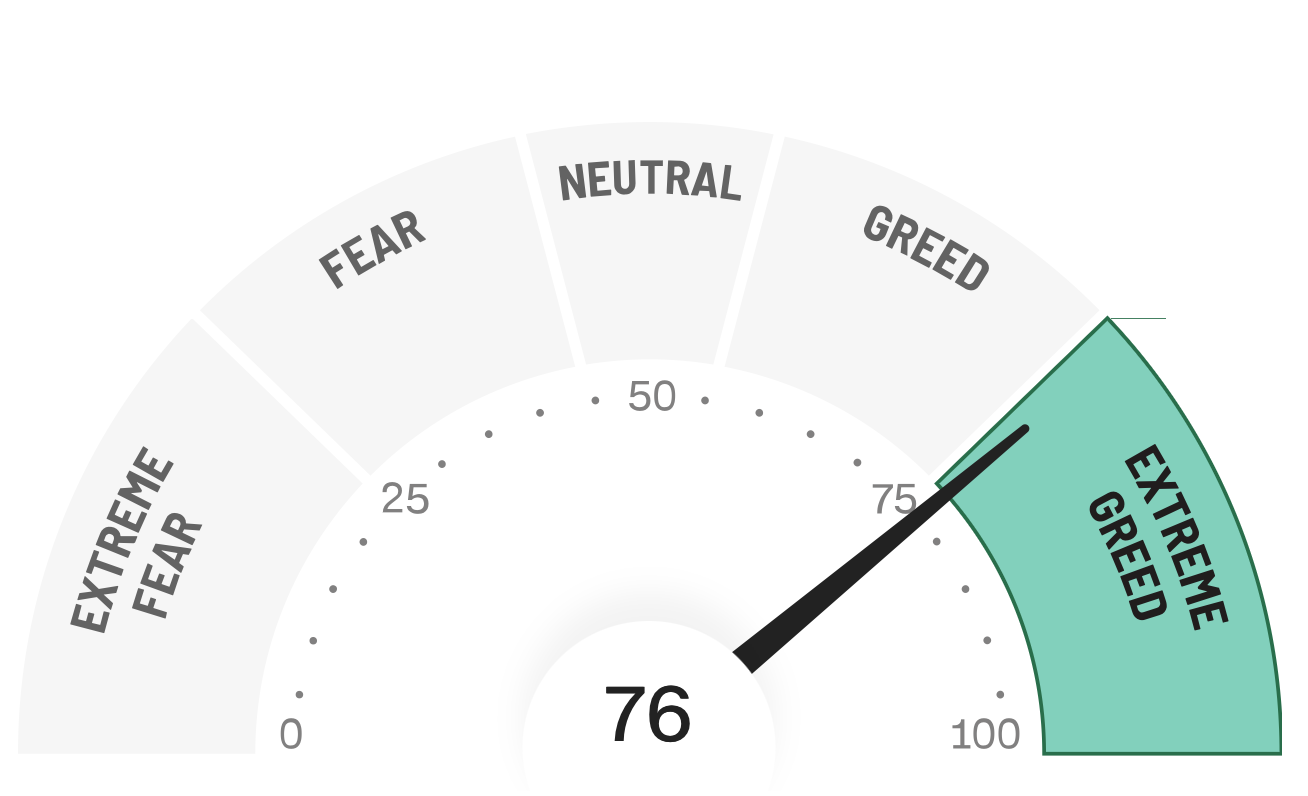

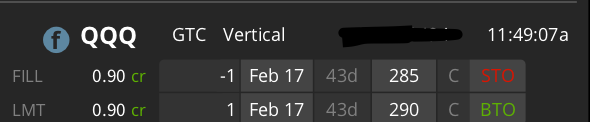

Sold a short $QQQ Feb 17th 285/290 call spread for a .90cr. Has 86% P50. @moneyvikings #hottrades #options #definedrisk #tastytrade pic.twitter.com/GZ7AVY0MMl

— Money Vikings (@moneyvikings) January 5, 2023

Tag: QQQ

Weekly Market Report

The Death of the 60/40 Portfolio Is Greatly Exaggerated I’ve seen so many articles, and listened to so many podcasts this week about the death of the 60/40 portfolio (60% Equities / 40% Bonds). Now I’m not saying it’s right for everyone, however just taking a look at the past 12 months is not how … Read More “Quick Hits for the Week of 10/23/22” »

Free Content, HotTrades

This is a defined risk trade/hedge in QQQ. On 9/28 we closed this out for a $68 Profit.