What if there was an easy way to build a $1 million investment portfolio?

Guess what, there is!

And here at Money Vikings we show you how in a clear and straightforward way.

How Much Should You Invest Each Month to Reach $1 Million?

Building wealth is a math game and a mindset shift. One of the most common questions people ask is “How much should I invest each month to become a millionaire?”

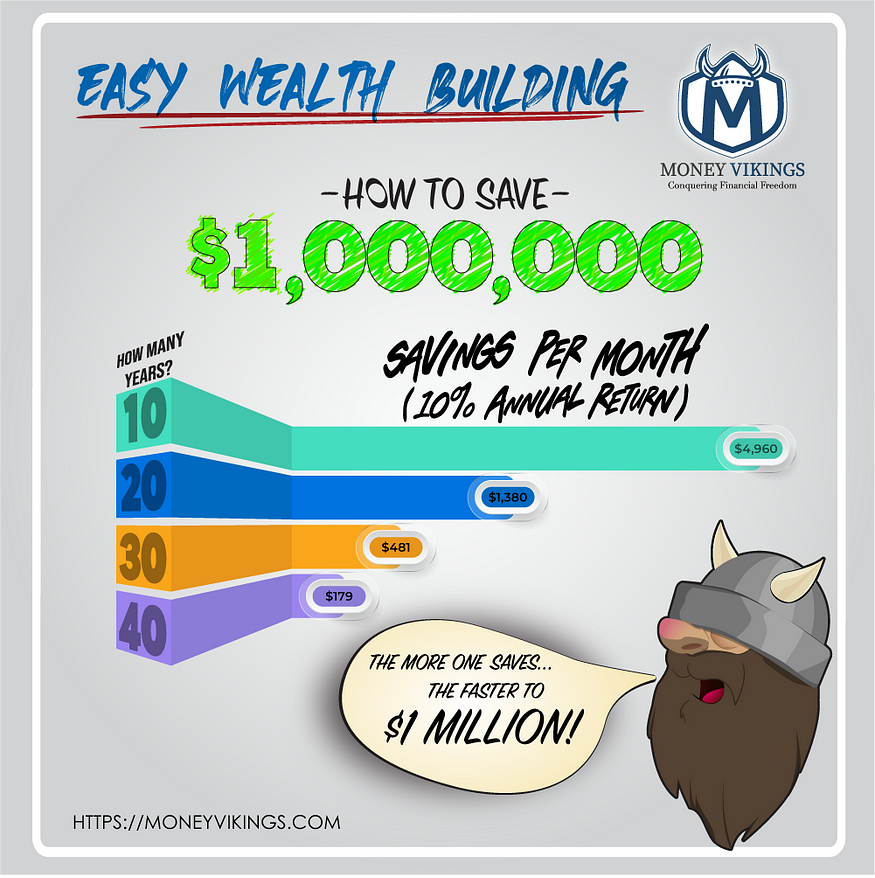

Using a 10% compound annual rate of return—a reasonable long-term estimate based on historical stock market performance—here are three scenarios showing what it takes over 10, 20, and 30 years.

Monthly Investment Targets to Reach $1,000,000

1. Over 10 Years — The Aggressive Path

1. Over 10 Years — The Aggressive Path

To reach $1 million in just a decade, you need to invest about $4,800 per month.

This is a high bar, but achievable for high earners or entrepreneurs looking for rapid wealth building.

2. Over 20 Years — The Realistic Builder Path

2. Over 20 Years — The Realistic Builder Path

With 20 years of compounding, the required monthly investment drops dramatically to about $1,750 per month.

This is a common target for disciplined savers who start investing in their 20s or 30s.

3. Over 30 Years — The Slow & Steady Millionaire

3. Over 30 Years — The Slow & Steady Millionaire

Give compounding enough time, and it works magic. To hit $1 million over 30 years at 10%, you only need to invest about $740 per month.

This is the classic long-term retirement investor’s path.

Key Takeaway

The longer your money has to compound, the less you need to contribute. Time is the greatest wealth-building tool—use it like a Viking sharpening his sword for the long game.