If you are a middle class wealth builder, or just need a practical straightforward guide to building wealth, then this is the book for you.

Money Vikings! Check out the ultimate guide to building middle class wealth. Soon to be a bestseller, this is the ultimate handbook for middle class wealth builders:

The “Raging 20’s” continue to rage on as we have witnessed in Davos this week. Global instability, new world ordering, high national debts, aging populations and MASSIVE tech AI disruption will continue to roil the world. When national debt is exploding, currencies are being debased, and geopolitical risk feels like background noise rather than a … Read More “3 Investments for Armageddon” »

American’s Are Gig Workers Now, Wealth Building Must Be Different Admittedly, much of our experience at Money Vikings wealth building has been based on someone having traditional employment with a company that offer benefits such as a 401k and health insurance. But for a growing number of Americans this is not longer reality. 78 Million … Read More “Gig Workers Wealth Building” »

You know that Money Vikings started calling this the “RAGING 20’s” a few years ago given all the major challenges facing the world. The post WW2 order is fragmented. The global order is shifting and technology like AI is disrupting every aspect of life. It is not all bad, but it is also not all … Read More “Money is Broken & The Consequences” »

Here are the Top 5 Legal Ways to Pay Less Taxes—simple, effective, and commonly used by high-income earners, business owners, and everyday taxpayers alike. These strategies apply broadly in the U.S. and many other tax systems, though details vary by country. Why is this critical to wealth building? When we go to withdraw money from … Read More “5 Ways to Pay Less Taxes (Legally)” »

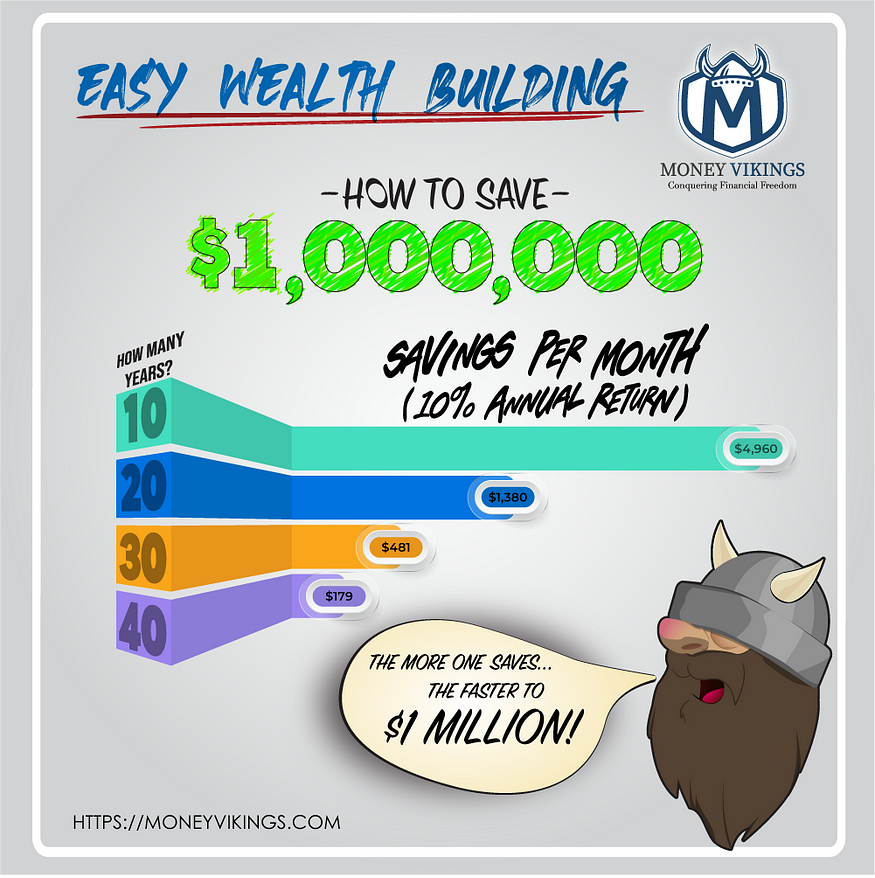

What if there was an easy way to build a $1 million investment portfolio? Guess what, there is! And here at Money Vikings we show you how in a clear and straightforward way. How Much Should You Invest Each Month to Reach $1 Million? Building wealth is a math game and a mindset shift. One … Read More “Easy Wealth Building to $1 MILLION” »