Let’s stop lying to ourselves, inflation has sucked for decades! We may be fooling ourselves to think that this is a new phenomena of high gas prices and expensive eggs after a Pandemic. But do not be fooled.

Housing, Childcare, Healthcare, College

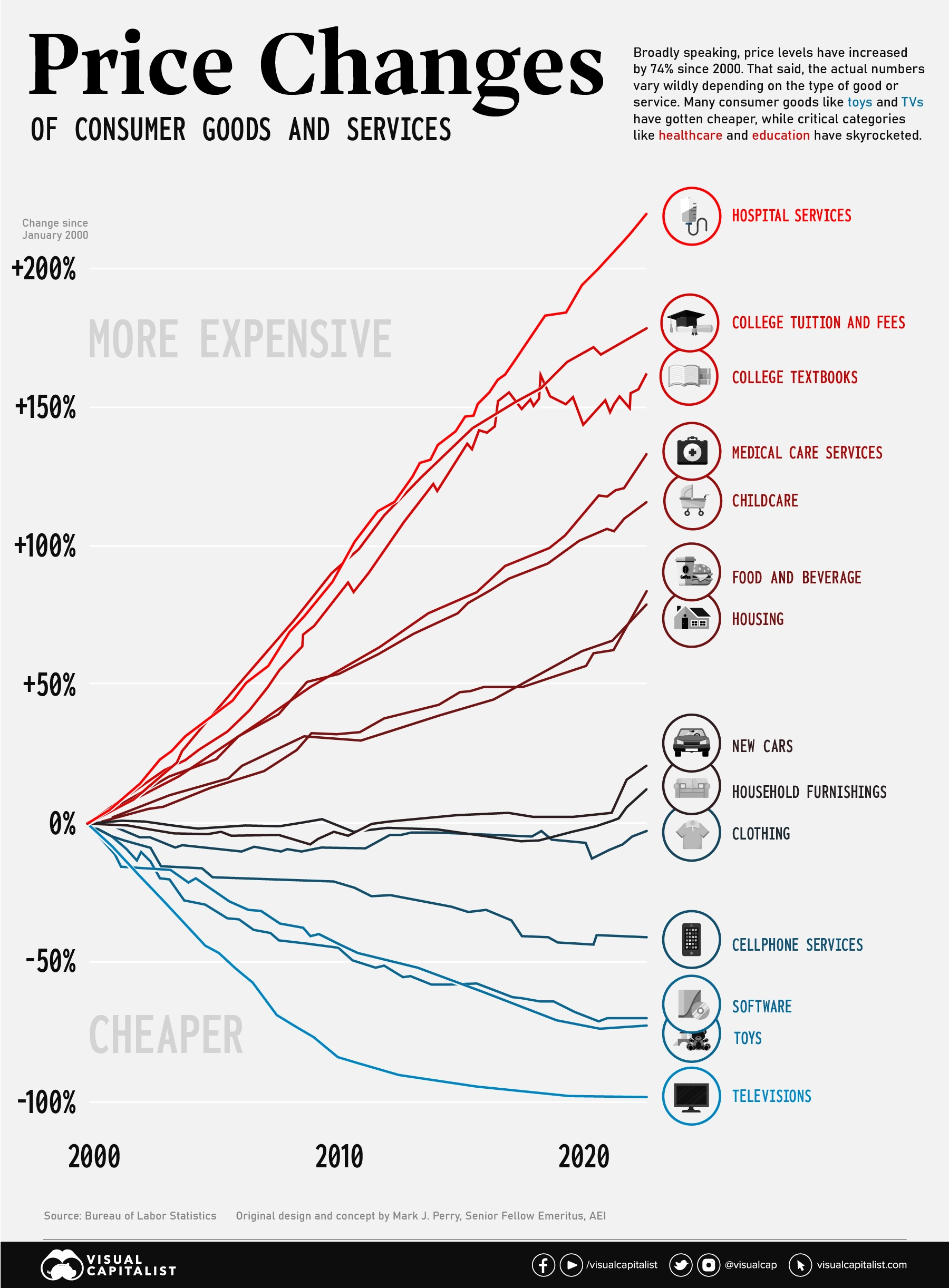

Look at this chart for a minute and get mad. The most important stuff in life has skyrocketed in costs the last two decades. And the crap we really don’t need like toys and TV’s has gone down. In fact, we really do not need TV’s because generally they are time wasters and full of commercials. Ok, I do like using my TV to watch The Mandalorian, but you get the idea here.

TV’s and Toys

All the important stuff in life like education, healthcare, housing and food has all skyrocketed in price over the years. But the shitty stuff that no one really needs like TV’s and Toys has come down in price and been deflationary.

A National Emergency About to Get Worse?

Given the global instability and the possibility of World War 3 on the horizon, inflation can actually get much worse. And this is well beyond the influence and control of the Fed who are determined to crush some aspect of the economy with higher interest rates.

An Abundance Agenda

What we really need on a national scale is an abundance agenda to aggressively invest and build. Build more housing, more hospitals, develop our manufacturing base and capacities, etc. The age old concept of adding more supply will help with the pressures of inflation.

Inflation Defense Systems

It is time to double down on the Money Viking inflation defense systems! Here are some specific actions we continue to take in order to prepare and thrive:

Specific Actions I Am Taking

Debt levels and type: It is high time to reduce and mitigate toxic high interest debt. Debt used for depreciating items such as clothes, trips, cars, etc. should be beat down to a manageable level.

Fortunately as a Money Viking, I do not have a lot of high interest toxic debt on depreciating things. In fact I have none. It is critical to remember in a volatile investing environment, if you can pay off high interest debt that is costing you 12, 15, or 20+%, that is a right away boost to net worth and wealth building. Being at close to zero debt right away makes your overall net worth so much stronger.

Good debt? I do believe there is such as thing as “good debt”. My favorite good debt is responsibly used debt amounts to buy real estate. There are tax advantages and you own a piece of a hard asset. If you own a home and were strategic enough to lock in one of those low low rates, then congratulations. Now is the time that essentially free money will help. You have minimized your monthly outlay and are not being eaten by high interest rates.

Defensive investments: About a year ago, Money Vikings started repositioning into more defensive investments. What does this mean?

In my opinion, simply speaking, defensive investments are traditional assets that actually make money and are tied to fundamentals. Examples are well managed real estate investment trusts and dividend aristocrats. One of our favorite analysts over at seeking alpha is Brad Thomas for his thorough and thoughtful analysis of quality REITs. Check it out here at seeking alpha.

Are you properly diversified into defensive investment vehicles. consumer staples, healthcare, utilities, etc. tend to withstand market turbulence during a recession. Also, perhaps not a bad idea to hold some cash, especially to pounce on market opportunities when. the next bull run starts.

Reduce spending: Are you finding ways to trim back on some expenditures?

About 6 months ago we started inflation defense systems (IDS’s), since inflation was showing no sign of abating. Even with inflation coming down, I would overshoot on these systems and continue the good cost reduction measures well into 2023.

If we have a recession, It is best to enter a recession with the ability to live lean. Many have been living high on the hog as the pandemic money piled up and we joyfully came out to live again. But now may be a good time to ramp back some of the frivolous spending and see what comes next in the economy.

Stay diversified: 2022 taught us that the experts do not always know the best investments. No one knows year to year how Mr. Market is going to react. Moreover, strategic diversification is critical to investing success time and time again.

I ask myself if I have portfolio exposure to various asset classes and industries. Diversified ETF’s with low expenses and equities like BRK-B allow easy diversification.

Emergency funds: It is always always always a good idea to have built an emergency fund, typically 6 months of emergency expenses. This buffers you from job losses or major challenges in life. If a recession hits and somehow your industry is effected, an emergency fund makes a major difference. As a result of this, I am currently focused on building back up a good emergency fund, because in the summer I had an emergency repair! Our HVAC went dead after 40 years of operating, go figure. But this wiped out the emergency fund, so time to rebuild before the next recession.

Don’t fixate, move forward: In summary,It can be easy to beat ourselves up over investment and life “mistakes”. But the reality is that none of use are all knowing perfect beings. We are trying to make it in a world of controlled chaos. Do the best you can each day and master the fundamentals of wealth building over the long run.

One unfortunate downside of the pandemic investing boom is that a whole younger generation of folks got wrapped up in the meme stock “to the moon” era. They believed that was a normal way to make money and build wealth. Unfortunately that was an artificially created situation based on easy money and social media driven madness. It was an era that was an anomaly. Learn from it and move forward into the current reality. No, we are not all going to become millionaires by putting a thousand dollars into a cryptographic code with cute dog marketing.

In summary, we need to get back to a reality — when making 6-8% return next year should be considered a success. It is not very often that 10x on an investment is a normal return.

Money Vikings

Thank you for joining us and enjoying the ideas we are discussing. We hope that they help you like they have helped us over the years. Keep strong Money Vikings!