Table of Contents

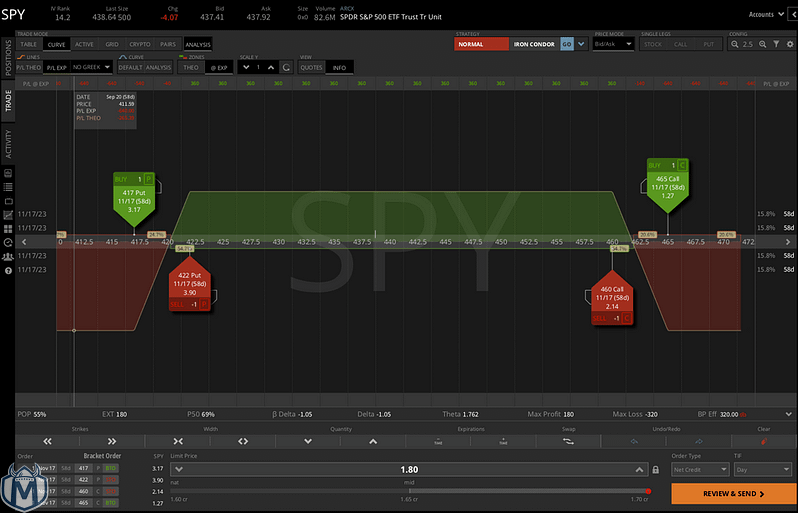

Yesterday 9/18, I opened a SPY Iron Condor out until November 17th, which seems like ages from now. I am hoping SPY stays between the dark blue lines of 422 and 460. I collected $180 in credit and am hoping to keep at least 50% of it when I close.

| Received At | Sep 19, 2023 1:12:25 PM EDT |

| Symbol | SPY |

| TIF | Day |

| Submitted Order Type | Limit @ 1.80 Credit |

Fill Details

- Bought 1 SPY 11/17/23 Put 417 @ 2.36

- Bought 1 SPY 11/17/23 Call 465 @ 1.92

- Sold 1 SPY 11/17/23 Put 422 @ 2.90

- Sold 1 SPY 11/17/23 Call 460 @ 3.18

10/3 Update

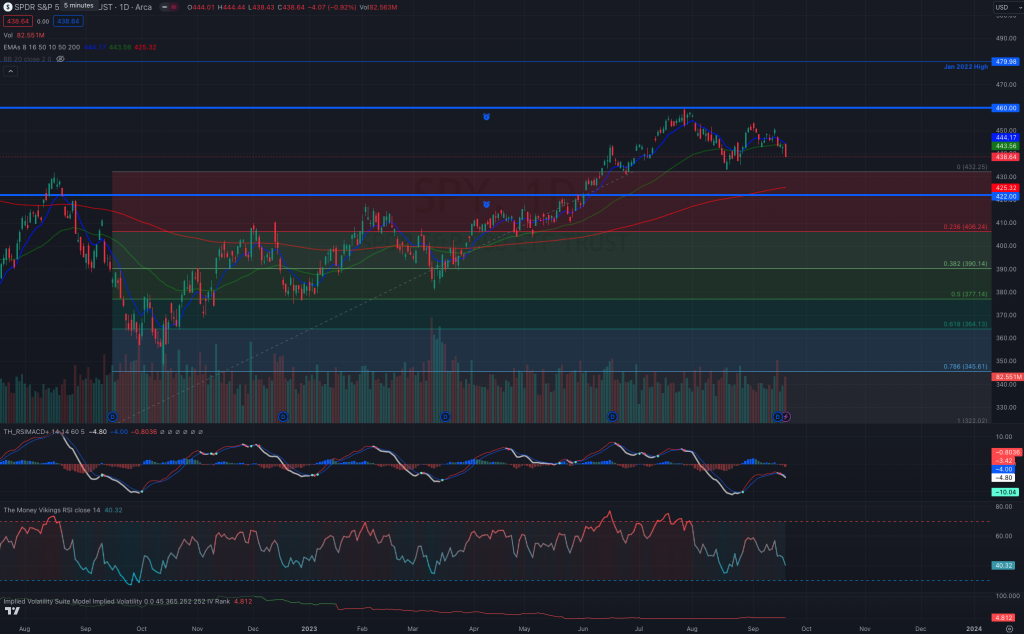

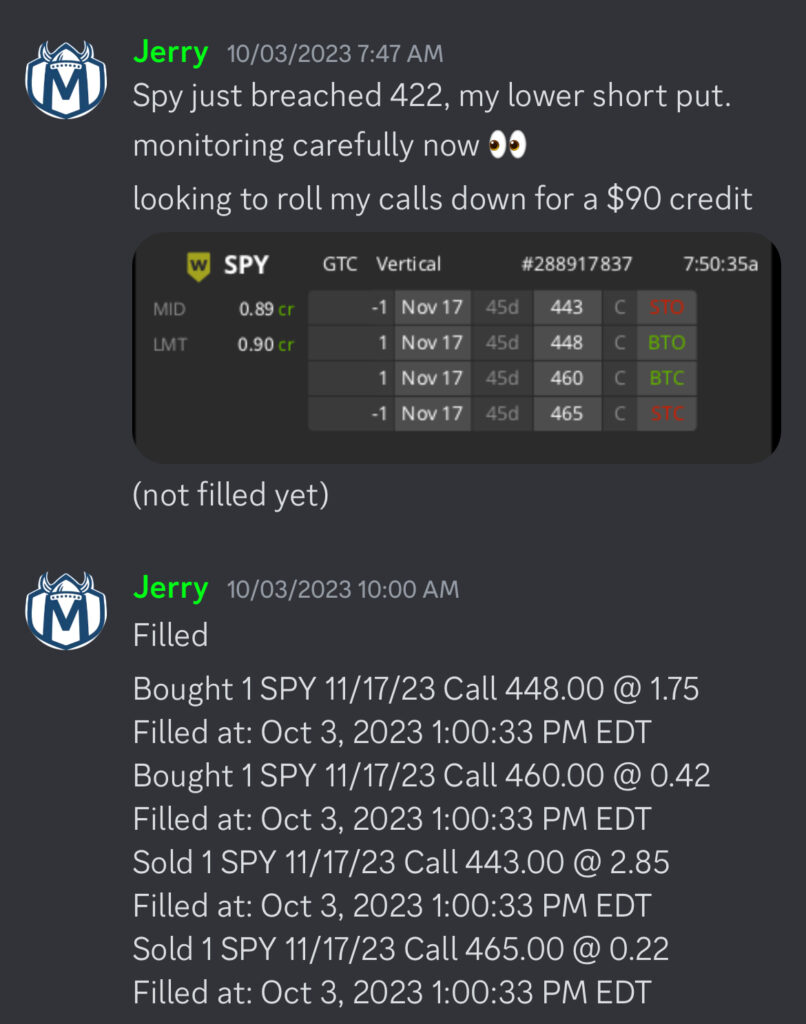

My Iron Condor in SPY has been giving me heart palpitations all week. It dipped below 422–twice! The first time it did that, I tried to stick to the plan, and roll the call side down, which I did for a nice $90 credit.

I am at break even now but that is a good thing considering where we were earlier this week. This trade goes all the way out way to November so I can wait if the support areas hold 419.

10/20 Update

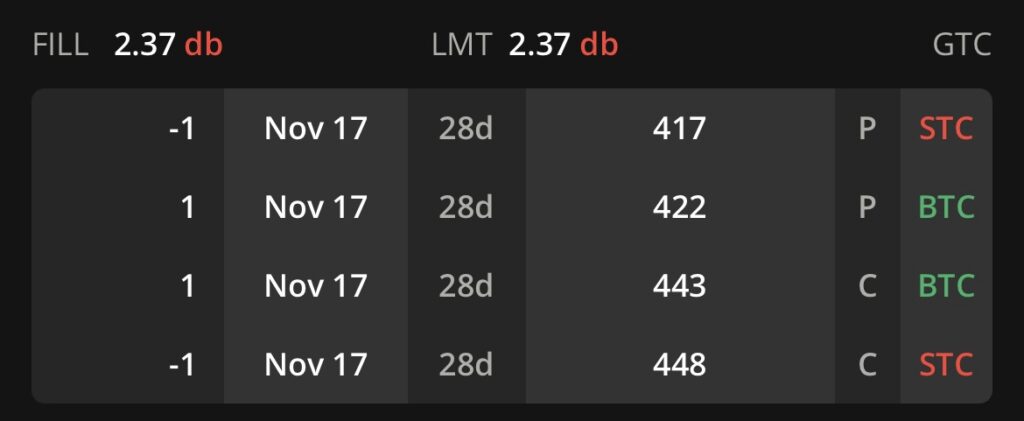

Up 30$ in this on a down day. Decided to close because it seemed like it was about to breach my 422 short put. SPY closed below 422 so I’m happy to have gotten out for a small profit. Next week , with a VIX over 20, will look to open another in SPY, IWM, DIA, or QQQ out to December.

Can You Trade Iron Condors for a Living?

I wouldn’t. An iron condor is a popular options trading strategy used by traders to generate income in a range-bound market. It involves selling both a put spread and a call spread simultaneously on the same underlying asset. The goal is to profit from the time decay of the options, as well as the expected lack of significant movement in the price of the underlying asset. Traders who trade iron condors for a living typically rely on the strategy’s ability to generate consistent income, as it allows them to take advantage of relatively low volatility and predictable price ranges. The limited risk involved in iron condor trading, compared to other strategies, also attracts traders looking for a more conservative approach to options trading.

How To Make $700 Per Week Trading Iron Condors by KM Brands

Non Directional Assumption

An iron condor offers traders the opportunity to capitalize on a non-directional market, where they can profit regardless of whether the price of the underlying asset goes up, down, or remains stagnant. This flexibility makes iron condors attractive for traders who seek to generate income in various market conditions. By combining the sale of both put and call spreads, traders can benefit from the premium received from the options while limiting their potential losses through the defined risk of the strategy. This risk management aspect is crucial for traders who rely on consistent profits to earn a living. Overall, iron condors provide a balanced approach to options trading, allowing traders to effectively manage risk while capitalizing on market conditions.

Where will SPY be in November?

The specific price movement of SPY in November cannot be predicted with certainty. However, an iron condor strategy allows traders to profit regardless of the price direction, making it suitable for uncertain market conditions like those in November.

An iron condor strategy involves selling both put and call spreads, which enables traders to generate income from the premium received while also limiting potential losses. This strategy’s risk management aspect is particularly important for traders who rely on consistent profits for their livelihood. Overall, iron condors offer a well-balanced approach to options trading, allowing traders to effectively manage risk and capitalize on various market conditions.

Uncertain Markets

The iron condor strategy provides traders with a way to navigate uncertain market conditions by allowing them to profit from a range-bound market. By selling both put and call spreads, traders can benefit from the premium received while also having limited potential losses. This strategy is particularly valuable for traders who depend on consistent profits for their livelihood, as it offers a strong risk management component. In summary, the iron condor strategy provides a balanced approach to options trading that enables traders to effectively manage risk and capitalize on different market scenarios.

1 Contract – Iron Condor in SPY : Hot🔥Trade

The iron condor strategy is a valuable tool for traders looking to navigate uncertain market conditions. By selling both put and call spreads, traders can benefit from the premium received while limiting potential losses. This well-balanced approach to options trading offers a strong risk management component, making it particularly valuable for those who rely on consistent profits. In summary, the iron condor strategy enables traders to effectively manage risk and capitalize on different market scenarios.