One day about a decade ago my grandfather handed me a short article clipped from a newspaper. It mentioned high quality investments to consider and one was ticker “O”.

Tag: investing

Elon Musk !! Every wonder what happens if you combine fractional share stock investing with starbucks coffee and cash app boosts? Well read on to find out…

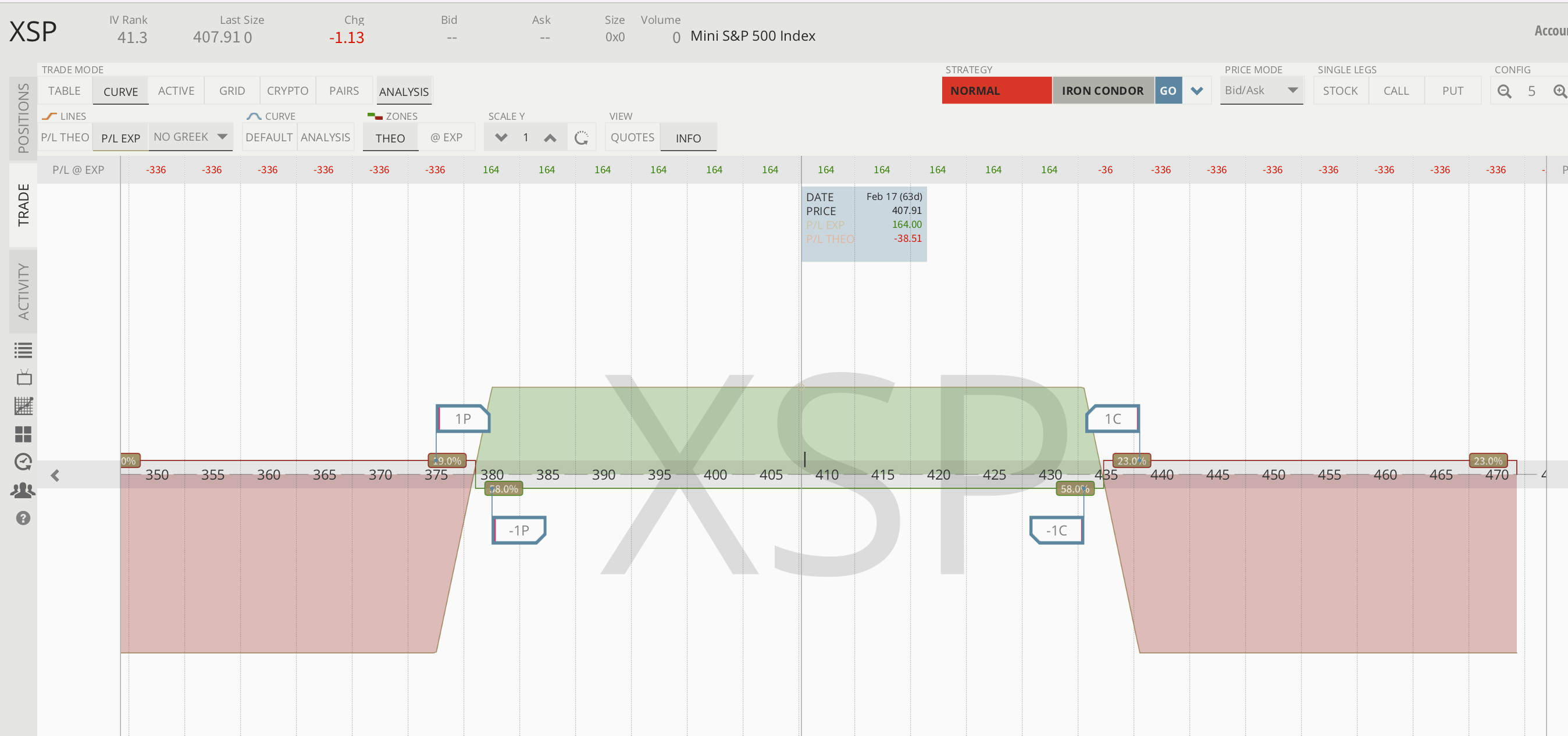

This article is about keeping a trading log for my trades. For my investments and retirement accounts, I manage them very differently. For the purposes of this article I’ll define a trade as a combination of 1 or more options combined with the buying or selling for at least 100 shares of stocks (i.e. for strategies like covered calls, wheeling, or cash secured puts.

Greg and Jerry have been friends for over a decade. They decided to sit down over a cold one and discuss Jerry’s favorite options trading strategies.

We would sit around all day adding to our holographic NFT collections and shooting to the moon with the latest social media fueled short squeeze stock. How about taking a look at Berkshire Hathaway though?

As many readers of The Money Vikings know, I primarily work in the realm of real estate investing. For centuries real estate has served as an attractive asset class that can preserve and grow wealth. Think about the wealth of Kings and Queens, it mainly derived from the ownership and productive use of real estate. As we … Read More “Are You Prepared for Real Estate Investing? 5 Things to Consider” »

For most of us in the middle class, our one main tool for building wealth is our 401k or self directed Individual Retirement Account. This is the basket of index funds that we are consistently contributing to in order to build wealth one lego brick at a time. The fact that this goes on a … Read More “3 Ways To Be A 401k Warrior” »

Welcome to our first installment of “MIM” – Millionaire in the Making. Here we provide highlights and top 3 tips from middle class folks who are on their way to building a million dollar net worth. The names are changed to protect identities online.

7 ways to build a wealth building “robot” army!