On a journey of financial, physical and mental health, I like to find ways to combine and compound efforts. What about harnessing the health benefits of coffee? Especially these days as we manage market turbulence and asset values depreciating. This brings us to our enjoyment of a good cup of coffee with a friend or … Read More “6 Powerful Health Benefits of Coffee, (SBUX) Starbucks Investment & Building Wealth” »

Category: Investing

Current Crisis! Or Opportunity of a Lifetime? At the moment it feels like the sky is falling in the markets and fear is in the air once again. The drumbeat of recession talk is strong and asset prices from equities to real estate are declining. What shall we do? Load up on canned goods and … Read More “7 Techniques to $1 Million Dollars (yes, it can still happen)” »

Our friends at all about cats estimated that the cost of a cat in 2022 is over 1000$ for the first year. I’ve read estimates that they can be upwards of 15K over their lifespans! But what is the cost of a faithful feline friend who lowers your blood pressure and warms your heart? What’s … Read More “YES! Cats are Very Expensive – Cat Toothpaste!!” »

We cover a way to assess our financial health in various stages

Our goal is to achieve a high level of financial health & wealth.

Let’s take stock of the current moment: inflation is running too hot as we exit the Covid 19 pandemic disruptions AND we are on the verge of WW3. Why do I mention this? Because in my opinion Bitcoin should have broken $100k based on this information. Use Case Hits the Real World The main use … Read More “Did Bitcoin Just Fail its First Big Test?” »

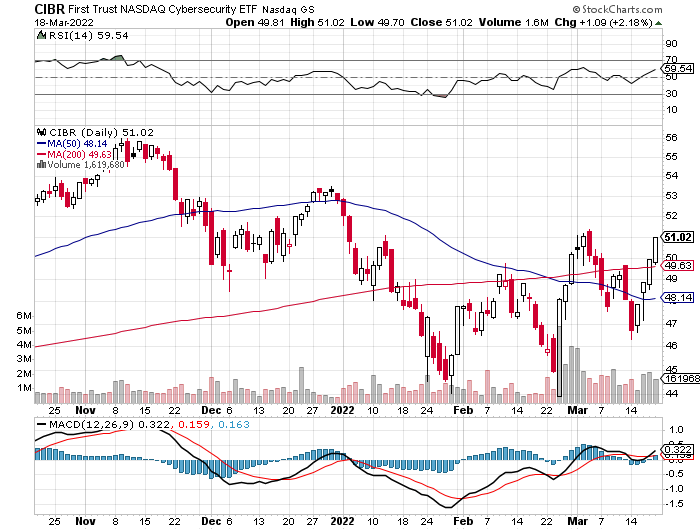

At Money Vikings we have talked a lot over the years about macro investing themes and the power they can bring to a portfolio and wealth building. These are those huge trends over the globe that really cannot be stopped. Aging populations, adoption of technologies, healthcare, pharma, climate disruptions all offer certain investment opportunities. We … Read More “CIBR – Cybersecurity” »

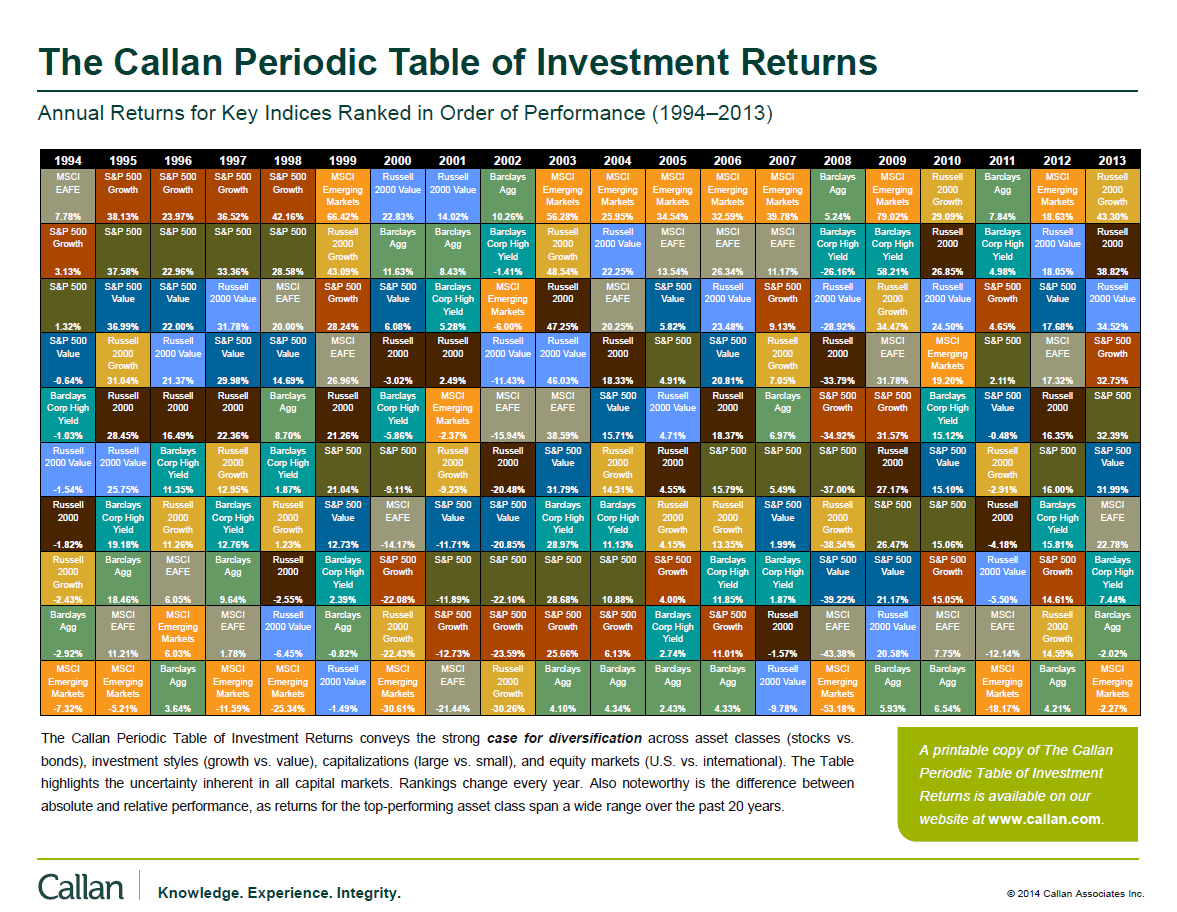

With the market volatility and stock market, bond market, and global markets in flux, you might think that Greg and I are worried. We are not! Why? Are we selling all our stock to catch all the gains we can before they are lost? No. We diversify our investments. We go into these markets fully … Read More “Why Diversify? The Callan Periodic Table of Investment Returns Shows Us” »